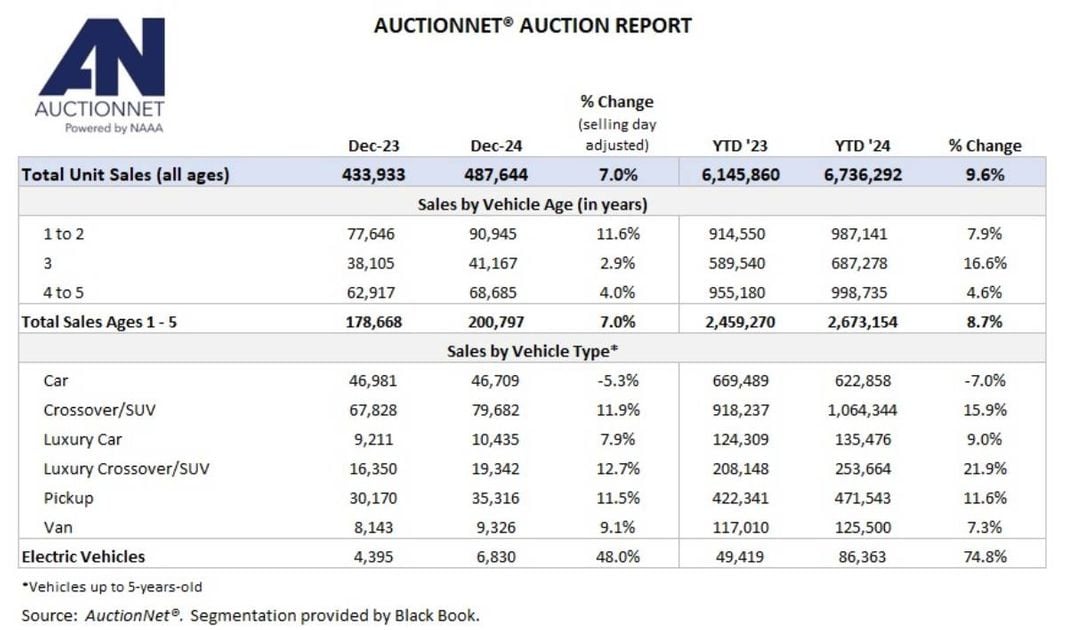

Across vehicle age groups, auction sales rose nearly 8% year-over-year in 2024 for 0–to-2-year-old vehicles, which includes a heavy mix of rental fleet units.

Total full-year AuctionNet wholesale sales reached 6.74 million vehicles, up 9.6% versus 2023’s full-year total, according to AuctionNet data released Jan. 10.

Auction sales have now increased for two consecutive years after reaching a post-pandemic low of 5.79 million units in 2022. Total sales hit 8.18 million in 2019.

Overall, 2024 marked another rebound year for auction sales following the post-pandemic nadir in 2022, figures show. Commercial sales were the primary reason for last year’s increase in sales, with broad-based growth across rental, commercial, off-lease, and repo units.

Dealer sales were also up, albeit ever so slightly. But while the market experienced an appreciable increase in 2024, we shouldn’t expect the same outcome this year.

AuctionNet wholesale auction sales reached 487,644 vehicles in December, up 7% over the previous year after adjusting for selling day differences (this December had one more selling day than last year). Sales fell 9.3% over the holiday-abbreviated month compared to November.

After running at a deficit for most of the year, dealer auction sales finished the year in positive territory but just barely, rising 0.5% yearly versus 2023. Commercial sales, on the other hand, experienced a strong rebound, increasing 23.7% year-over-year.

Sales Rise Across 0-5 Year-Old Vehicles

Across vehicle age groups, auction sales rose nearly 8% year-over-year in 2024 for 0–to-2-year-old vehicles, which includes a heavy mix of rental fleet units.

Driven in large part by higher off-lease volume, sales of 3-year-old vehicles increased 16.6% last year compared to 2023, while 4-to-5-year-old vehicle sales grew 4.6%.

For December, 1-to-5-year-old light truck and passenger van sales grew 11.3% compared to last year (selling day adjusted), while mainstream car sales fell 5.3%. Luxury car sales grew 7.9% because of far more Genesis and Tesla units running through the lanes. In fact, Tesla luxury car volume (i.e., Model 3) increased 135% on a full-year basis, pushing the brand’s share of total luxury car sales to 8%, equal to Cadillac and just behind Lexus’ 10%. BMW held the highest share at 20%).

As a collective, mainstream car sales fell 7% last year, pickup sales grew 11.6%, mainstream CUV/SUV sales jumped nearly 16%, and luxury CUV/SUV volume jumped almost 22% (due mostly to an acute rise in Tesla Model Y sales).

Tesla luxury car volume (i.e., Model 3) increased 135% on a full-year basis, pushing the brand’s share of total luxury car sales to 8%, equal to Cadillac and just behind Lexus’ 10%.

Electric Vehicles Sales Soar in 2024

Pivoting to electric vehicles, EV sales increased 48% in December compared to last year (selling day adjusted), and they finished the year up 74.8% versus 2023.

Sales of Tesla units more than doubled, rising 113% to nearly 63,000 units in total last year, and the brand’s models were responsible for 58% of all EV auction sales in 2024.

In fact, Tesla auction sales were so prolific in 2024 that its vehicles comprised the top 10 selling EVs for the year.

Mixed Auction Outlook for 2025

S&P Global Mobility is predicting a 41% decline in total lease maturities over the first half of 2025 versus the same period in 2024, which means that off-lease flows into auctions will also decrease.

Given that new vehicle sales into rental fleets were essentially flat in 2024, only a modest improvement in rental auction volume should be expected in 2025, while repossession volume will likely continue flattening as it did over the latter half of 2024 through 2025.

The lower off-lease volume will also affect dealer-used vehicle acquisition efforts, which means that dealer appetite for trade-ins will grow (thereby stymying auction inflows).

On net, physical auction sales in 2025 look flat with some downside bias. That said, the market should see some growth return in 2026 due to the double-digit improvement in new vehicle sales and leasing in 2023.

Monthly AuctionNet data is derived from 265 NAAA member auctions that use AuctionNet. Analyzed by Larry Dixon, vice president of auction data solutions, it is considered the most comprehensive source of wholesale auto auction sales data in the U.S.