Bitcoin’s recent price volatility has led many to wonder if large-scale bitcoin hodlers are taking advantage of price dips to accumulate more bitcoin. While some metrics may initially suggest an increase in long-term holdings, a closer examination reveals a more nuanced story, especially after the current prolonged period of choppy consolidation.

Are Long-Term Holders Accumulating?

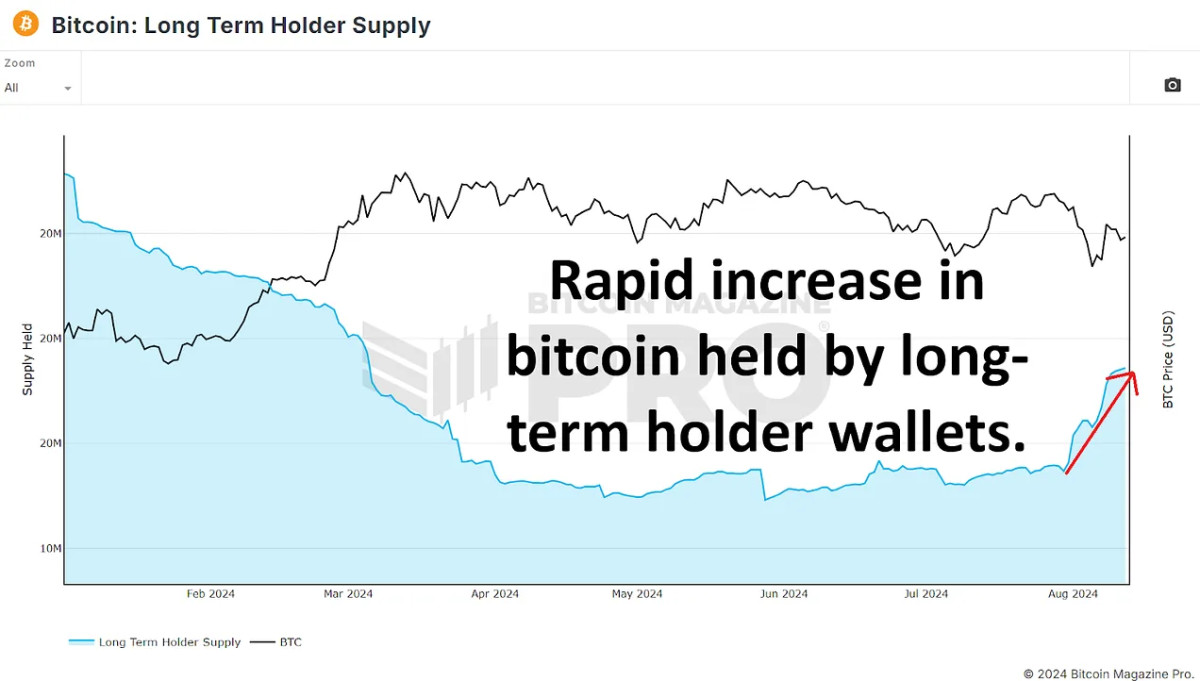

Upon initial observation, long-term Bitcoin holders are seemingly increasing their holdings. According to the Long Term Holder Supply, since July 30th, the amount of BTC held by long-term holders has increased from 14.86 million to 15.36 million BTC. This surge of around 500,000 BTC has led some to believe that long-term holders are aggressively buying the dip, potentially setting the stage for the next significant price rally.

However, this interpretation might be misleading. Long-term holders are defined as wallets that have held BTC for 155 days or more. This week we’ve just surpassed 155 days since our most recent all-time high. Therefore, it is likely that many short-term holders from that period have simply transitioned into the long-term category without any new accumulation occurring. These investors are now holding onto their BTC, hoping for higher prices. So in isolation, this chart does not necessarily indicate new buying activity from established market participants.

Coin Days Destroyed: A Contradictory Indicator

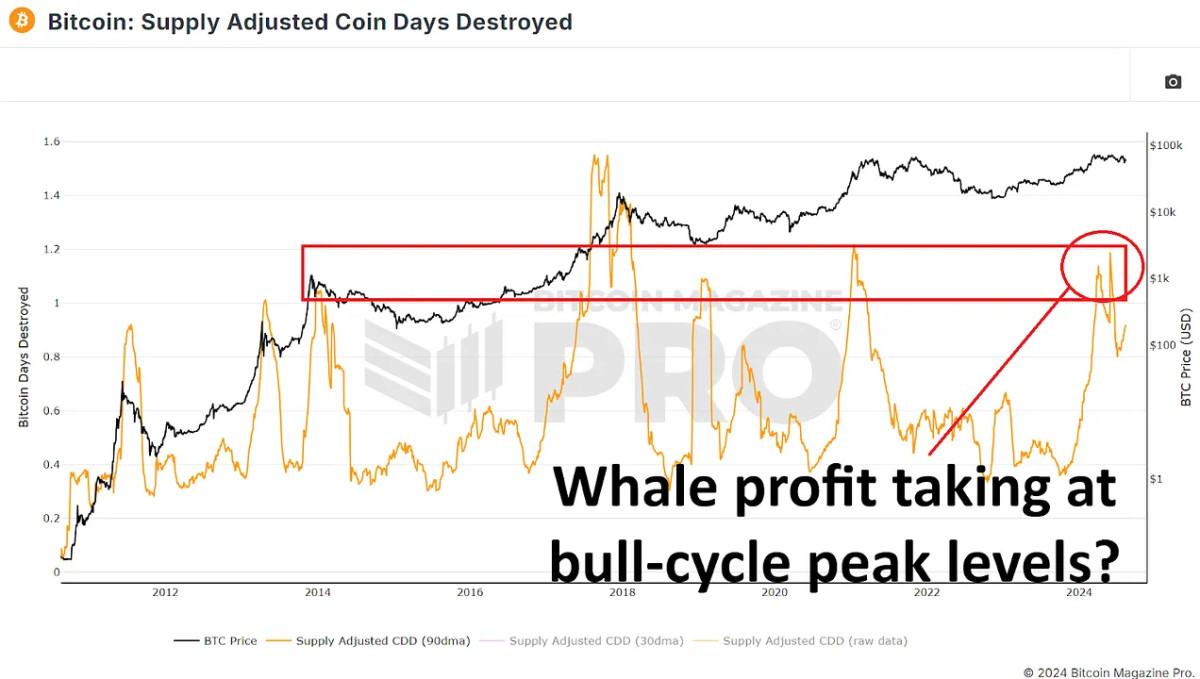

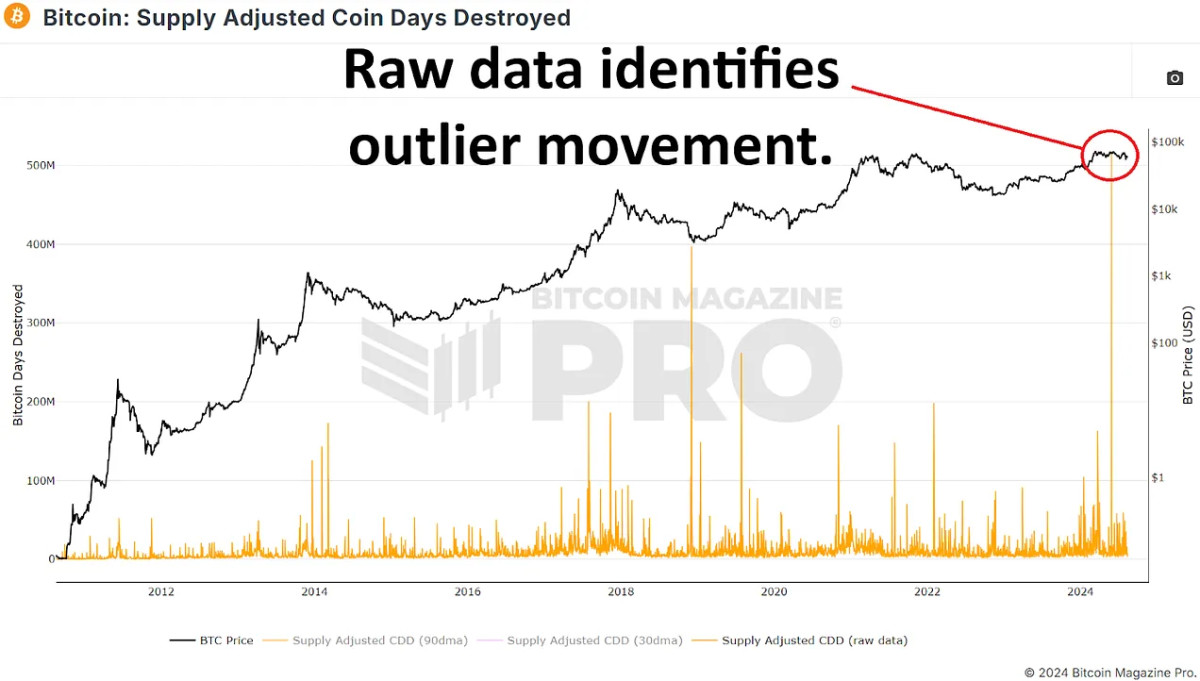

To further explore the behavior of long-term holders, we can examine the Supply Adjusted Coin Days Destroyed metric over the recent 155-day period. This metric measures the velocity of coin movement, giving more weight to coins that have been held for extended periods. A spike in this metric could indicate that long-term holders possessing a substantial amount of bitcoin are moving their coins, likely indicating more selling as opposed to accumulating.

Recently, we have seen a significant increase in this data, suggesting that long-term holders might be distributing rather than accumulating BTC. However, this spike is primarily skewed by a single massive transaction of around 140,000 BTC from a known Mt. Gox wallet on May 28, 2024. When we exclude this outlier, the data appears much more typical for this stage in the market cycle, comparable to periods in late 2016 and early 2017 or mid-2019 to early 2020.

The Behavior of Whale Wallets

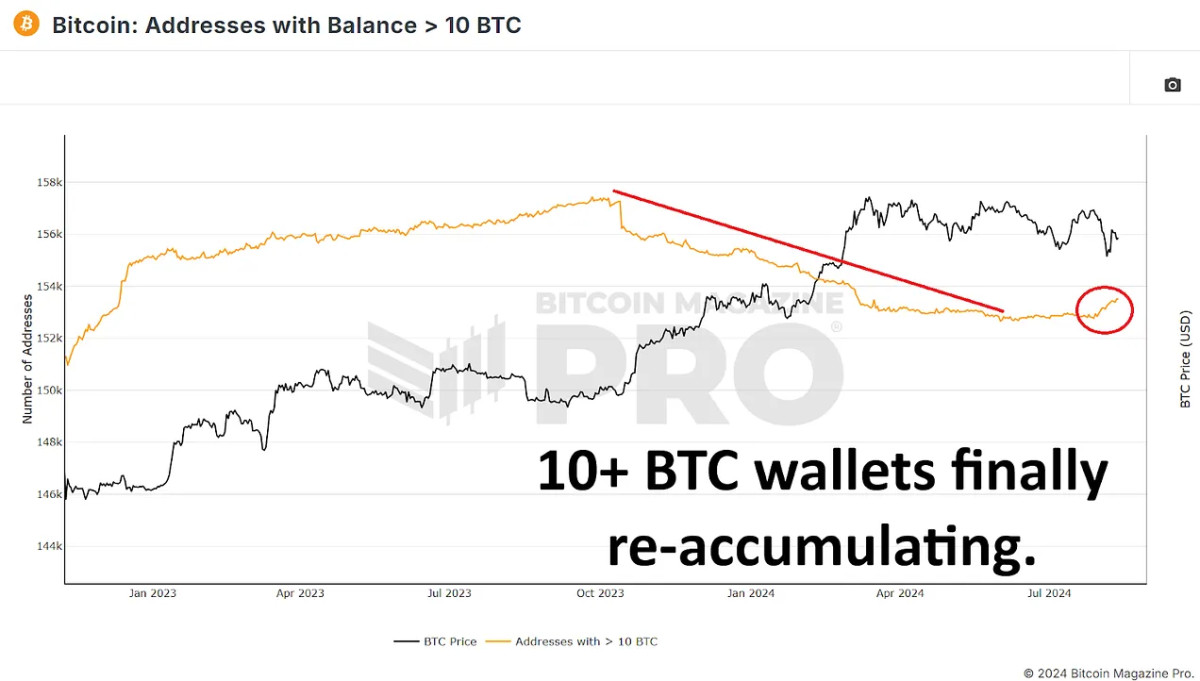

To determine whether whales are buying or selling bitcoin, analyzing wallets holding substantial amounts of coins is crucial. By examining wallets with at least 10 BTC (minimum of ~$600,000 at current prices), we can gauge the actions of significant market participants.

Since Bitcoin’s peak earlier this year, the number of wallets holding at least 10 BTC has slightly increased. Similarly, the number of wallets holding 100 BTC or more has also seen a modest rise. Considering the minimum threshold to be included in these charts, the amount of bitcoin accumulated by wallets holding between 10 and 999 BTC could account for tens of thousands of coins bought since our most recent all-time high.

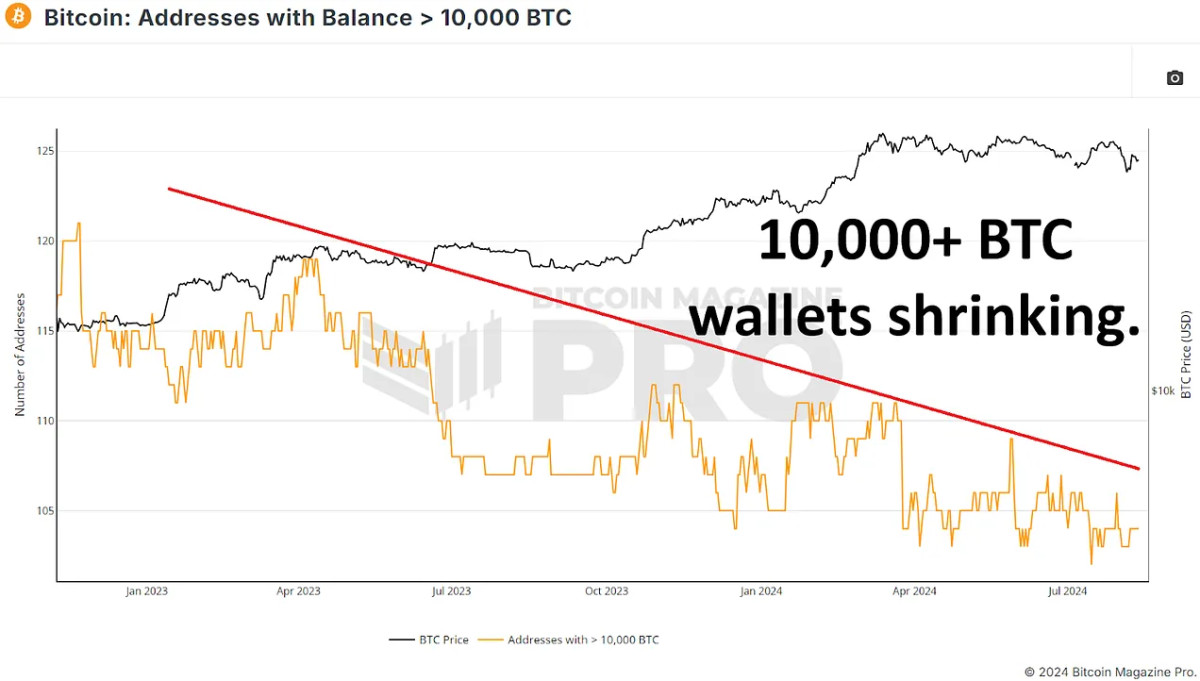

However, the trend reverses when we look at larger wallets holding 1,000 BTC or more. The number of these large wallets has decreased slightly, indicating that some major holders might be distributing their BTC. The most notable change is in wallets holding 10,000 BTC or more, which have decreased from 109 to 104 in the past months. This suggests that some of the largest bitcoin holders are likely taking some profit or redistributing their holdings across smaller wallets. However, considering most of these extremely large wallets will typically be exchanges or other centralized wallets it’s more likely these are a collection of trader and investor coins as opposed to any one individual or group.

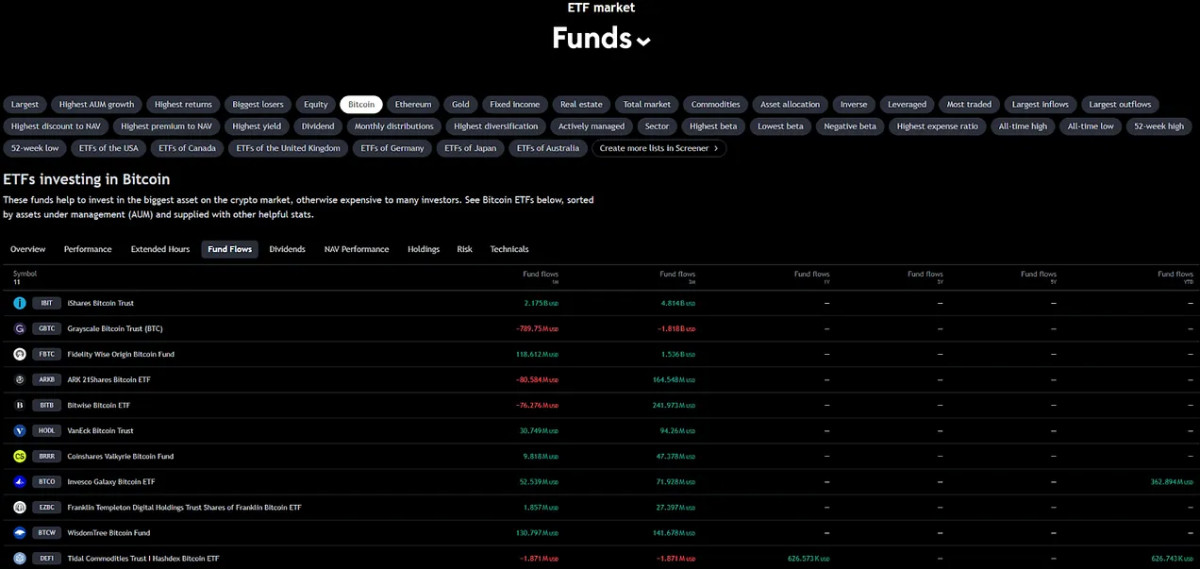

The Role of ETFs and Institutional Inflows

Since reaching a peak of $60.8 billion in assets under management (AUM) on March 14th, the BTC ETFs have seen an AUM decrease of around $6 billion, however when taking into account the price decrease of bitcoin since our all-time high, this roughly equates to an increase of approximately 85,000 BTC. While this is positive, the increase has only negated the amount of newly mined Bitcoin during the same period, also 85,000 BTC. ETFs have helped reduce selling pressure from miners and potentially from large holders but haven’t significantly accumulated enough to impact the price positively.

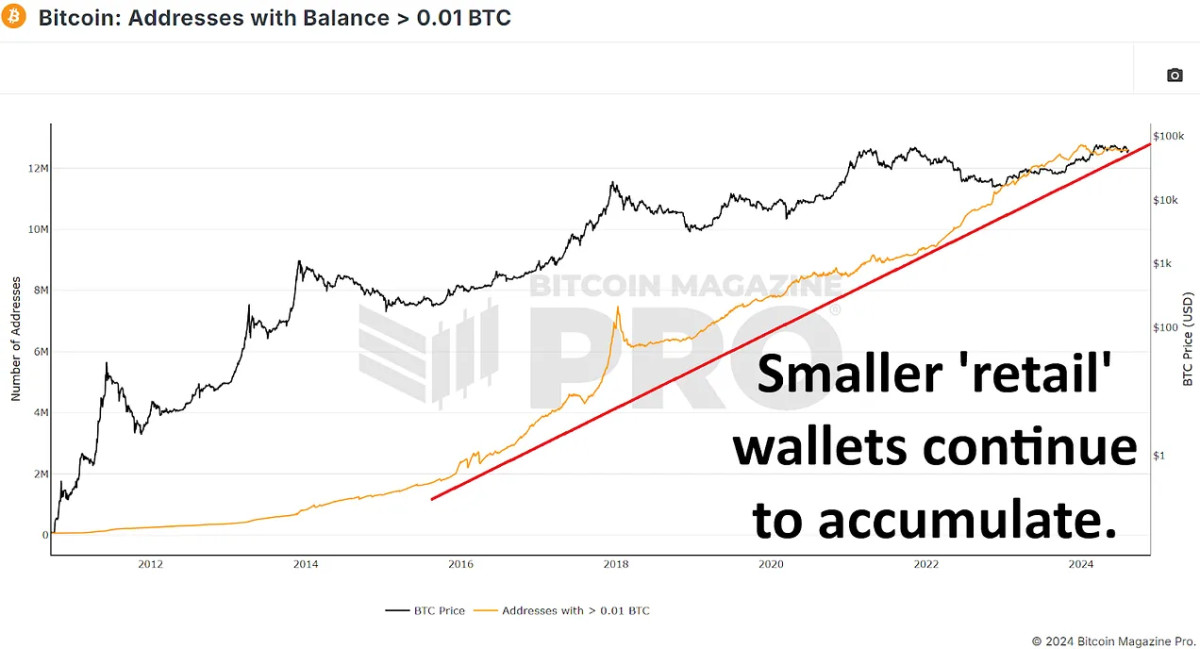

Retail Interest on the Rise

Interestingly, while big holders appear to be selling BTC, there has been a significant increase in smaller wallets – those holding between 0.01 and 10 BTC. These smaller wallets have added tens of thousands of BTC, showing increased interest from retail investors. There’s been a net change of around 60,000 bitcoin from 10+ BTC wallets to smaller than 10 BTC. This may seem alarming, but considering we typically see millions of bitcoin switch from large and long-term holders to new market participants throughout an entire bull cycle, this is not currently any cause for concern.

Conclusion

The narrative that whales have been accumulating bitcoin on dips and throughout this period of chopsolidation does not seem to be the case. While long-term holder supply metrics initially appear bullish, they largely reflect the transition of short-term holders into the long-term category rather than new accumulation.

The increase in retail holdings and the stabilizing influence of ETFs could provide a strong foundation for future price appreciation, especially if we see renewed institutional interest and continued retail inflows post halving, but is currently contributing little to any Bitcoin price appreciation.

The real question is whether the current distribution phase seizes and sets the stage for a new round of accumulation, which could propel Bitcoin to new highs in the coming months, or if this flow of old coins to newer participants continues and likely suppresses the potential upside for the remainder of our bull cycle.

🎥 For a more in-depth look into this topic, check out our recent YouTube video here: Are Bitcoin Whales Still Buying?

And don’t forget to check out our other most recent YouTube video here, discussing how we can potentially improve one of the best bitcoin metrics: