The battle between business and labor is headed for a high-stakes showdown at the California Supreme Court this week over a ballot measure that would tip the balance of power at the state Capitol.

The court on Wednesday will hear oral arguments on the legality of an initiative backed by business interests that strips the state Legislature and the governor of the ability to increase taxes and requires statewide voter approval.

In an effort to quash the measure, Gov. Gavin Newsom and legislative Democrats petitioned the Supreme Court last September to intervene. They argued that change revises the California Constitution and, therefore, can only be placed on the ballot if ratified during a Constitutional Convention or by winning a two-thirds vote in the Legislature.

The proposal has alarmed Democrats, unions and their liberal allies. The measure could limit state and local funding, hamstring the ability to generate new money for programs and make it more challenging for the governor and Legislature to offset a budget deficit in an economic crisis without slashing progressive policy priorities.

“They should be afraid because the people of California are fed up,” said Rob Lapsley, president of the California Business Roundtable, a proponent of the measure. “This gives the people of California the right to vote on future taxes, and voters are going to support it if it’s on the ballot.”

If approved by voters, the proposal would mark a historic win for the business community. Lapsley said establishing new checks and balances on taxation is essential to creating jobs and attracting companies to California.

Labor unions representing state workers, teachers, police and firefighters have joined forces with Democrats and dozens of other organizations to ask the high court to strike down the measure. They argue it would impair essential government functions and threaten services that rely on state dollars.

“I want to make it clear that the ‘Taxpayer Deception Act’ lets wealthy corporations, who can afford expensive campaigns, to block taxes on their industry while regular Californians, regular people, shoulder more of the cost of critical services,” said Tia Orr, executive director of Service Employees International Union California, which is leading the charge to defeat the measure on the ballot.

Officially dubbed the “Taxpayer Protection and Government Accountability Initiative,” the measure pushed by Lapsley’s group and the Howard Jarvis Taxpayers Assn. asks voters to require local governments to vote on all fee increases, which can now be approved administratively. The threshold to increase local special taxes would increase from a majority to a two-thirds vote of the people.

Fee increases at the state level, which are often approved by state agencies and boards, would need support from a majority of the state Legislature. The measure would expand the requirements necessary for a statewide tax increase, which currently can be done with a two-thirds vote of the Legislature. Under the ballot measure, support from a majority of California voters also would be required.

Taxes are often applied to the sale of goods, or income, for example, and pay for a variety of government expenses through the state general fund. A fee is typically collected and spent on a more specific service.

The measure expands the definition of taxes and restricts the potential use of fees to only cover the cost of the service, potentially prohibiting government from redirecting revenue to other purposes to close a budget deficit. The changes would take effect retroactively and reverse many local and state tax and fee increases approved since Jan. 1, 2022.

Carolyn Coleman, chief executive of the League of California Cities, said the new requirements for local ballot measures would effectively erase more than 100 measures that voters already approved with a majority vote. In Walnut Creek, for example, it would rescind a local public safety measure that voters approved with a 65% majority in 2022. The measure funded five new police officers, she said.

Opponents and supporters said that, if approved, the taxpayer ballot measure could rescind the “mansion tax,” also known as Measure ULA that took effect in Los Angeles last year. The measure applies a 4% charge on all property sales above $5 million and a 5.5% charge on sales above $10 million to fund housing and homelessness initiatives.

Lapsley argued that the mansion tax is “singularly the worst economic policy that you can possibly have in freezing the whole commercial, retail and residential real estate market in L.A.”

The luxury real estate market has slowed since the measure was adopted, but the charge has also raised about $215 million in funding in its first year.

Groups that have given money directly to Lapsley’s campaign, or funded other political action committees that contribute to the measure, include developers, landlords and real estate managers, among others with an interest in ending the mansion tax.

In addition to weighing whether the state ballot initiative constitutes a revision of the Constitution, the Supreme Court will consider the argument that it affects essential government functions.

Erin Mellon, a spokesperson for Newsom, said that in the event of a financial crisis the measure would require government to wait up to two years for the next ballot to raise taxes, “potentially putting lives and our economy at risk.”

“The governor is not a proponent of tax increases and has fought against propositions seeking to add new taxes, but the recession 15 years ago — and the current budget challenges facing our state — underscore the need for government to use every tool in the toolbox to respond to crises,” Mellon said in a statement. “The California Supreme Court should keep this radical effort led by wealthy business interests off the ballot because it violates the Constitution by attempting to completely restructure our system of government in a way that will prevent government from protecting Californians from future crises.”

The case elevates the ongoing fight between progressive labor unions and the business community from the halls of the state Capitol to California’s highest court.

Companies in California often complain that they can’t get a fair shake in a state Legislature dominated by Democrats and under the powerful political influence of labor unions. Business interests are increasingly turning to the statewide ballot to block and stall progressive laws from taking effect, or to push their own policy agenda directly to voters.

The proposed ballot measure could deal a blow to labor unions and other interest groups, who would find it more challenging and more expensive to convince voters to increase taxes to back their policy agenda than making their case just to legislators. Requiring lawmakers to pass bills to increase every new fee could also become a political challenge.

Lapsley and others said it’s rare for the Supreme Court to take up this type of pre-election challenge to a ballot measure. He said he feels that it’s fair for the court to consider the arguments, but he criticized Democrats for bringing the case.

“The fact that the Legislature and the governor are using taxpayer money to try and deny the voters of California, over 1.43 million who signed our petitions, the opportunity to have their voice heard is a direct violation of everything they talk about in terms of direct democracy,” Lapsley said. “They’re complete hypocrites when it comes to this case.”

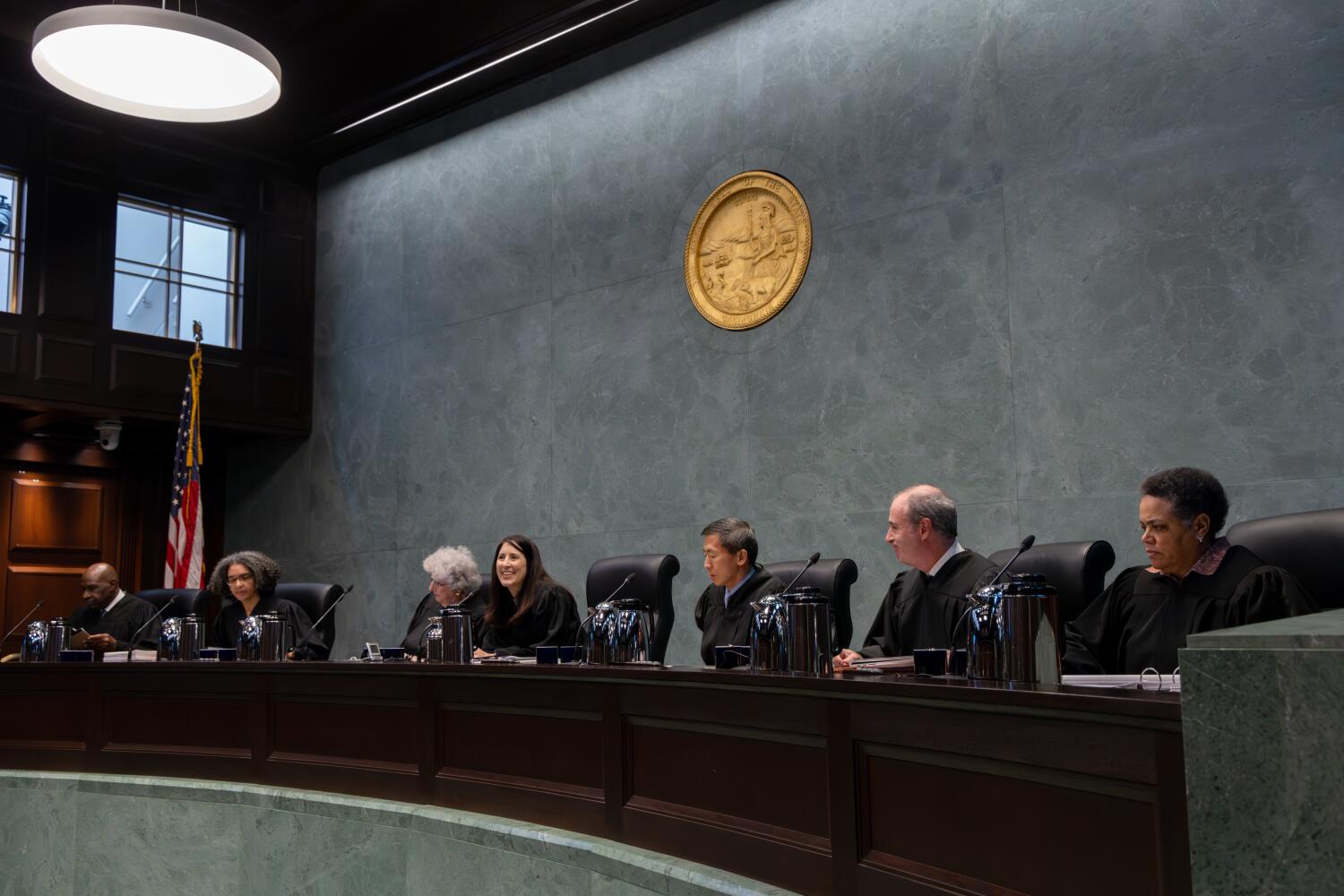

Each side has 30 minutes to present an oral argument to the Supreme Court on Wednesday in San Francisco. The court is expected to release a ruling sometime before the June 27 deadline for measures to qualify for the ballot.