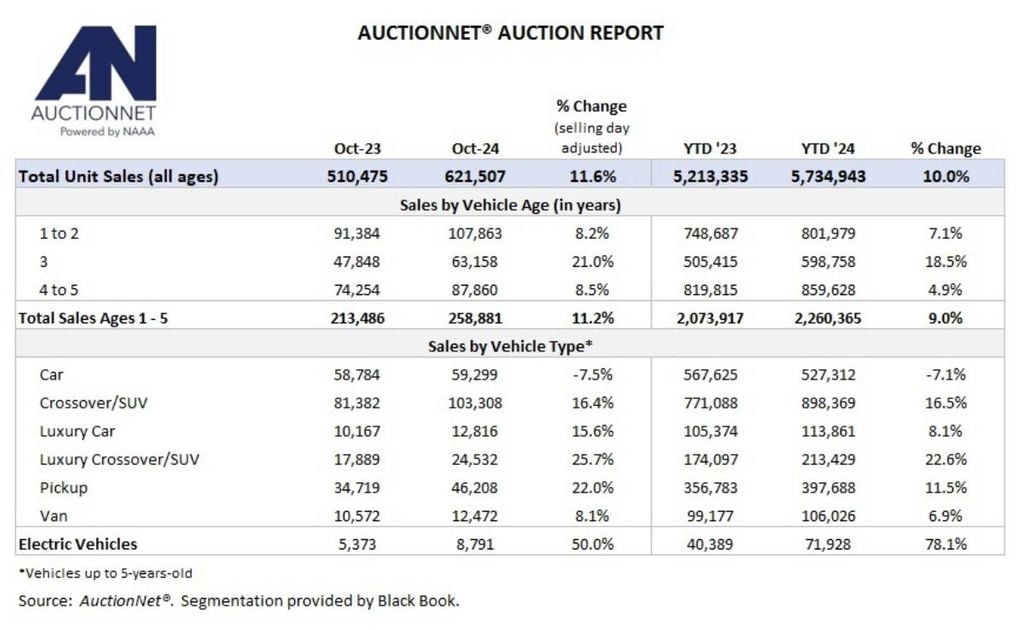

Auction sales of vehicles up to 5-years-old — which includes most off-lease, rental, and fleet company sales — rose 11.2% compared to last October.

Wholesale auction sales exceeded 621,500 units in October, up 11.6% on a prior year basis after adjusting for selling day differences since October had two more selling days than last year, according to recent figures from AuctionNet.

Sales over the first 10 months of the year reached 5.73 million units, +10% versus 2023’s YTD total.

However, sales fell 1.6% in October compared to September, with a large 7.7% decline occurring in the southeast region, including states heavily affected by hurricanes Helene and Milton.

Note that auction sales in Florida, Georgia, and North Carolina were equal to, if not slightly higher, over the second half of October than they were in the lead-up to Hurricane Helene at the end of September, indicating that deferred sales were made up over the back half of October.

Commercial, Dealer Sales Up

Dealer and commercial sales finished the month up 6.9% and 18.4%, respectively, compared to last October, but dealer sales fell 4.1% versus September while commercial sales grew 1.8%.

As shared in last month’s update, commercial sales over the first seven months of the year grew by an average of more than 28% per month versus the prior year, however, growth averaged a lesser 14.7% per month in August and September (selling day adjusted). October’s commercial sales growth rate was a bit higher than in the two previous months but was well below what was observed over the first half of the year.

One- to Five-Year-Old Car Sales Rise

On a selling-day adjusted basis, auction sales of vehicles up to 5-years-old—which includes most off-lease, rental, and fleet company sales—rose 11.2% compared to last October but were up a lesser 0.6% versus September.

Total sales were down 1.6% month over month. The rise in sales of 1-5-year-old vehicles indicates that the volume for vehicles older than 5 years fell modestly last month.

The month-to-month rise in late model auction sales was due to a 0.6% increase in 1-2-year-old vehicle sales; 3-year-old vehicle sales fell 2.3% compared to September, while 5-4-year-old sales dropped 0.8%.

At the segment level, mainstream car sales were 7.5% lower than in October 2023, due mostly to the continued decline in compact car volume.

Vehicle Segment Sales Vary

At the segment level, mainstream car sales were 7.5% lower than in October 2023, due mostly to the continued decline in compact car volume. Volume for the group was down 2% year-over-year through October, while midsize car volume was up 2%.

Pickup and CUV/SUV sales were 21% higher, on average, last month than in October 2023, while luxury car sales were nearly 16% higher. Note that the luxury car group includes electric vehicles, many of which are Teslas.

Removing EVs from the luxury car mix places year-over-year growth at a lesser 5% (all figures selling day adjusted).

EV Sales Still Going Strong

Sales volume for electric vehicles was up 50% in October on a prior year basis (selling day adjusted), but growth has leveled off from the +90-100% range observed from March through June.

On a monthly basis, EV sales were 3.6% lower in October than in September. Through October, EV auction sales stood at 91,600 units, up 80% versus 2023, with share of total AuctionNet sales reaching 1.6%.

Monthly AuctionNet data is derived from 265 NAAA member auctions that use AuctionNet. It is considered the most comprehensive source of wholesale auto auction sales data in the U.S.